Flexible Lending Solutions

Affordable loans for overseas Filipino workers with low interest rates.

Quick Approval Process

Get your loan approved swiftly to meet your urgent financial needs.

Global Accessibility

Access our services from anywhere in the world, tailored for OFWs.

Common Questions

What is FastCash?

FastCash offers lending services for overseas Filipino workers with competitive interest rates.

How to apply for a loan?

To apply, submit an online application form with required documents for processing your loan quickly.

What are the interest rates?

Our interest rates range from 0.2% to 0.1%, making loans affordable for overseas Filipino workers globally.

Yes, we cater to all OFWs.

Who is eligible for loans?

1. How much can I borrow?

Answer: Loan amounts range from ₱200,000 up to ₱5,000,000, depending on your eligibility and requirements.

2. What are the interest rates?

Answer: We offer fixed low rates:

₱200,000 – ₱499,999 → 0.2% monthly interest

₱500,000 – ₱5,000,000 → 0.1% monthly interest (special rate for higher amounts)

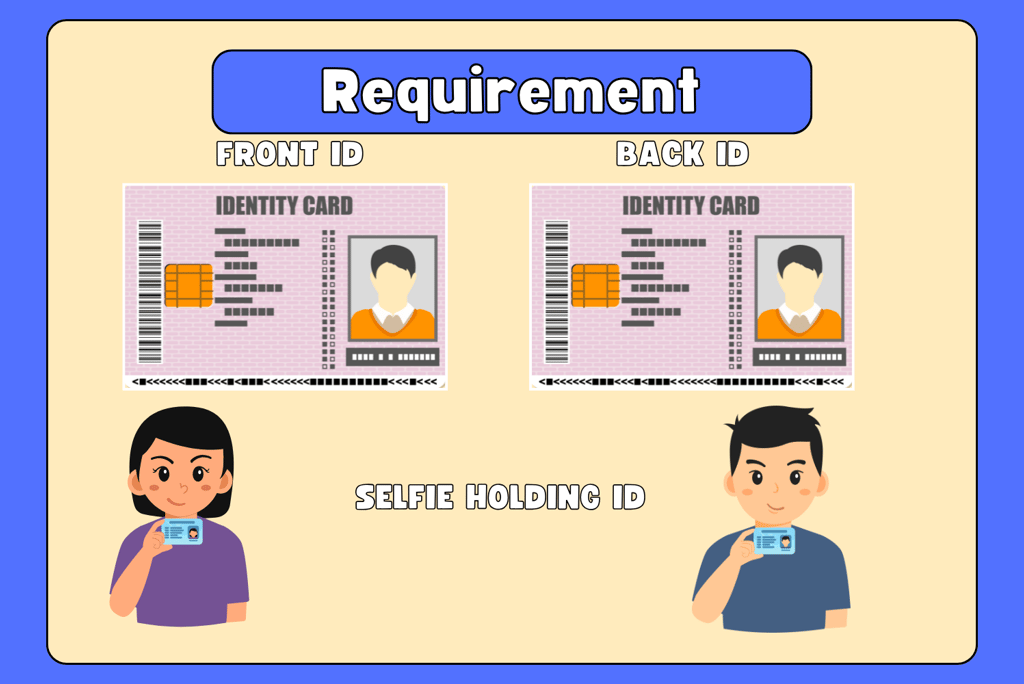

3. What documents do I need to apply?

Answer: You only need:

Valid ID (Passport, UMID, Driver’s License, etc.)

Proof of Employment/Income (Payslip or Contract for OFWs)

Active Bank Account

Completed online application form

4. How long does approval take?

Answer: Registration takes just 5 minutes online. Approval is processed within 24–48 hours once requirements are complete.

5. How do I receive the loan?

Answer: After approval, your loan is credited directly to your registered bank account.

6. What are your working hours?

Answer: Our support team is available from 10:00 AM to 10:00 PM, Monday to Sunday.

7. Can I apply even if I’m overseas?

Answer: Yes. Our platform is 100% online, so OFWs and clients abroad can apply easily.

8. When is the payment due date?

Answer: Installments are collected every 15th of the month through your registered bank account.

9. Is this company legit?

Answer: Yes. We are SEC-registered in the Philippines and partnered with SM Investment Corporation. You may verify our registration directly on the SEC website.

10. What happens if I can’t pay on time?

Answer: If you miss your due date, a late payment charge may apply, and your credit record may be affected. We recommend contacting your loan assistant immediately so we can help you arrange a solution and avoid additional penalties.

Questions

Requirement to apply loan

📌 Loan Requirements

To apply for a loan with EZ FAST LENDING CORP., please prepare the following:

Valid Government-Issued ID

(Passport, UMID, Driver’s License, SSS, or any accepted ID)Proof of Income

For OFWs: Employment contract / recent payslip / remittance slip

For Local Applicants: Certificate of Employment, payslip, or bank statement

Bank Account Details

(For direct transfer of loan proceeds)Active Contact Information

Mobile number

Email address

Completed Online Application Form

Register and apply through our secure online platform.

Customer Feedback

Hear from our satisfied clients worldwide.

FastCash made my loan process quick and easy. Highly recommend their services!

Maria Santos

Manila

I was impressed by the low interest rates and excellent customer service. FastCash truly understands the needs of OFWs.

John Reyes

Dubai

★★★★★

★★★★★

Contact

Get in touch with our team today.

Follow

Support

© 2025. All rights reserved.